Meteora: A Deep Dive into Solana Dynamic Vaults

State of the DeFi market

In 2021, Solana's Total Value Locked (TVL) reached an impressive peak of 10 billion. By May 2022, Solana's TVL had already hit a high of 6 billion. However, the landscape shifted with the event known as the "UST collapse" in May 2022.

As evident, maintaining funds in wallets presents a challenge for users, and it's an even greater task for builders to retain their customers' funds. At the time of writing, Marinade stands as the leading protocol on Solana, holding nearly ~180M in TVL.

The success of Marinade can be attributed to its focus on liquid staking yield and automation, simplifying yield management for its users. This mirrors the rise of Yearn Finance in 2020, which gained popularity due to its ability to manage complex operations across multiple DeFi protocols on Ethereum.

Now, looking at the leading DeFi protocols on major blockchains such as Ethereum, BSC, and Avalanche, yield aggregator platforms consistently rank in the top 20.

Ethereum:

BSC:

Avalanche:

So, where does Solana stand in terms of a yield aggregator protocol? This article will delve into this question and explore the flexibility of this platform in various market conditions compared to current yield aggregator protocols.

Introduction

In the rapidly evolving world of Decentralized Finance (DeFi), the ability to seamlessly move assets is a critical component. Amidst this landscape, one project is making significant strides in redefining how liquidity is managed and optimized - Meteora. Built on the Solana blockchain, Meteora's mission is ambitious yet straightforward - to become the liquidity backbone of Solana. It aims to do this by facilitating stablecoin liquidity, lending protocol capital, and deep capital efficient Automated Market Maker (AMM) pools.

The Problem Meteora Solves

Liquidity Providers (LPs) and protocols in the decentralized finance (DeFi) world often face hurdles. These include temporary losses, inefficient use of capital, and difficulty adjusting to market changes. These problems can affect how much profit they make and how long they can keep providing liquidity.

Temporary losses, or impermanent losses, happen when the price of a token in a liquidity pool changes a lot from the price when it was first put in. This can lead to losses for LPs, especially when prices are very volatile. Also, many protocols don't use the capital in liquidity pools effectively, which can lead to lower profits for LPs.

On top of that, many protocols struggle to adjust to market changes. This can be a big problem because the DeFi market can change very quickly. Protocols that can't adjust their strategies to these changes can become less profitable.

Meteora's Dynamic Vaults are designed to solve these problems. They can change their strategies based on market conditions, which can help reduce the risk of temporary losses and make better use of capital. This can lead to higher profits for LPs and a more sustainable way to provide liquidity.

What's more, Meteora's Dynamic Vaults are designed to be very flexible and adaptable. They can change their strategies in real-time as the market changes, which helps them stay profitable even when the market is volatile. This adaptability makes Meteora stand out from other protocols in the DeFi world and positions it as a leader in providing liquidity.

How Meteora’s Dynamic Vaults Work?

At the heart of Meteora's innovation is the concept of Dynamic Vaults. These are smart contracts that automate the process of yield farming, which is a common strategy in DeFi where users lend their assets to earn returns. However, yield farming can be complex and risky, requiring users to constantly monitor different platforms and adjust their strategies based on changing market conditions.

Dynamic Vaults are automated yield farming strategies that aim to optimize returns for liquidity providers (LPs). They are designed to automatically rebalance the capital invested by LPs across various platforms, thereby eliminating the need for manual tracking and risk management. This is a significant advancement in the DeFi space, as it allows even average users to take advantage of yield farming without the need for constant monitoring and adjustment.

Dynamic Vault's Key Features

Meteora's ecosystem is built around a suite of innovative features designed to optimize liquidity and yield for its users. These features, including the Dynamic Vault Program, Vaults Overview, Keeper, and Rebalance Crank, work harmoniously to create a robust and efficient DeFi platform.

Dynamic Vaults Overview

Meteora's Dynamic Vaults are like a bank where users and other systems can deposit or withdraw money (assets) anytime. These assets are then spread out to different lending platforms, such as Solend & Tulip. The amount of money sent to each platform is decided based on the potential profit (yield percentages) and safety measures (risk management strategies).

Main Components of the System

Vault: Each Vault is like a storage box that holds a specific type of money (token assets), such as USDC or SOL. Most of this money is sent to different lending platforms to earn profit. Users and other systems can easily put money into each Vault.

Keeper - Hermes: Hermes is like a manager who handles complex tasks. It keeps an eye on lending platforms, calculates the best way to spread out the money across these platforms, and tracks important data from them. It also watches out for risks and is ready to pull out money when certain limits are reached.

SDK Module (Integration APIs): To make it easy for other apps and systems to work with our Dynamic Vaults, we've created a simple toolkit (SDK) and are building a library of ready-to-use modules and code samples.

Dynamic Vault Program

The Dynamic Vault Program includes components like the Vault, Strategy Handler, and Treasury. The Vault is like a storage box for money, the Strategy Handler decides how to spread out the money to different lending platforms, and the Treasury holds rewards and fees.

The Vault keeps track of balances from various strategies, and at any time, the total money in the Vault must equal the money in the vault and total money in all strategies.

Keeper

The Keeper keeps an eye on the profit rate (APY) of each lending platform every hour and sends instructions (rebalance cranks) to redistribute money across different platforms. Factors that influence where the money is sent include profit rate, total deposit, deposit limit, and usage rates of the lending pool. Instructions are sent every few minutes, so users start earning profit just a few minutes after depositing in the vault. Note that the Keeper can only deposit in predefined strategies and cannot claim tokens.

Rebalance crank

Imagine you're a part of a dynamic system, a system that's constantly adjusting and rebalancing to ensure fairness. Welcome to the world of the Rebalance Crank!

When an operator submits a deposit_strategy or withdraw_strategy transaction, the Rebalance Crank springs into action. It's like a vigilant guardian, ensuring that the yield generated by the lending platforms is distributed fairly among the liquidity providers (LPs).

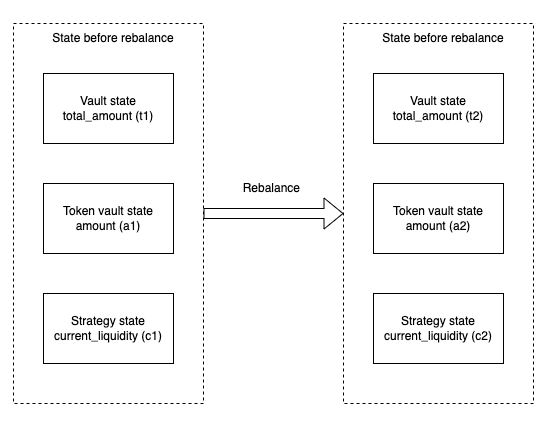

Picture this: before the rebalance, we have a set of state variables, including strategy.current_liquidity (let's call it c1). After the rebalance, these state variables get a makeover, with strategy.current_liquidity now being c2.

The total accrued interest after the rebalance is calculated as profit = (c2+a2) - (c1+a1). This profit is then added to the total amount t1 to get the new total amount t2 = t1 + profit.

But here's the twist: to prevent potential sandwich attacks, the system doesn't immediately release the entire yield to the LPs. Instead, it's like a slow drip of coffee, gradually releasing the yield over a pre-determined period of time.

This involves defining several state variables, including Total_amount (the total amount of liquidity collected), Last_updated_locked_profit (total locked profit, updated every time we do rebalancing), Last_report (timestamp of the last rebalancing run), and Locked_profit_degradation (rate at which the profit will be unlocked in % per second).

When a user adds or removes liquidity, the get_unlock_amount function is used to calculate the unlocked_amount value. This value is then used instead of vault.total_amount to calculate the total LP to mint or burn.

This mechanism ensures that an attacker cannot gain any of the yield if they withdraw their tokens immediately after rebalancing. They will also only gain a fraction of the total yield if they withdraw within the next few minutes.

For a more detailed explanation and mathematical formulas, please refer to the original documentation. It's like a treasure map, guiding you through the intricate workings of the Rebalance Crank.

Case Studies

Meteora's Dynamic Vaults have proven their worth in real-world scenarios, demonstrating their ability to optimize yield and protect capital. Let's delve into two case studies that highlight the effectiveness of Dynamic Vaults in action.

Case Study 1: The Solend.fi USDH Exploit

In the world of DeFi, exploits and hacks are unfortunate realities that can lead to significant losses. One such incident occurred with Solend.fi, a lending protocol on the Solana blockchain. An exploit in the protocol led to a significant devaluation of the USDH stablecoin.

However, LPs who had their capital in Meteora's Dynamic Vaults were protected from this incident. The Keeper, monitoring the state of the vaults, detected the abnormal fluctuation in the value of USDH. Acting swiftly, it triggered the Rebalance Crank to withdraw the capital from the affected pools and reallocate it to safer ones. This automatic response protected the LPs' capital from the exploit, demonstrating the effectiveness of Meteora's risk management framework.

Case Study 2: The USDC Depreciation Event

Another incident where Meteora's Dynamic Vaults proved their worth was during a significant depreciation event of the USDC stablecoin. In this scenario, the Keeper played a crucial role in protecting the LPs' capital.

As the value of USDC started to drop, the Keeper detected the risk and triggered the Rebalance Crank. The capital was swiftly withdrawn from the affected pools and reallocated to safer ones. This quick response protected the LPs' capital from the depreciation event, further demonstrating the effectiveness of Meteora's risk management framework.

Real-world Applications

Beyond these case studies, Meteora's Dynamic Vaults have numerous real-world applications. They serve as a powerful tool for yield optimization and risk management for a wide range of users, from individual investors to institutional ones.

For individual investors, Dynamic Vaults simplify the process of yield farming. They eliminate the need for constant monitoring and adjustment of strategies, allowing even average users to take advantage of yield farming opportunities. Furthermore, the comprehensive risk management framework provides a safety net, protecting their capital from potential risks.

For institutional investors, Dynamic Vaults offer a way to optimize the yield on their capital while minimizing risk. The automatic rebalancing and risk management features allow them to deploy large amounts of capital with confidence.

Moreover, Dynamic Vaults are not limited to just yield farming. They can also be used in other DeFi applications, such as lending and borrowing platforms. By automatically allocating capital to the most profitable opportunities, they can optimize the returns on loans and reduce the cost of borrowing.

In brief conclusion, Meteora's Dynamic Vaults have proven their worth in real-world scenarios and have a wide range of applications. They serve as a powerful tool for yield optimization and risk management, making DeFi more accessible and safer for all users.

Deposit Walkthrough

This part will help you with my app experience at the Meteora site

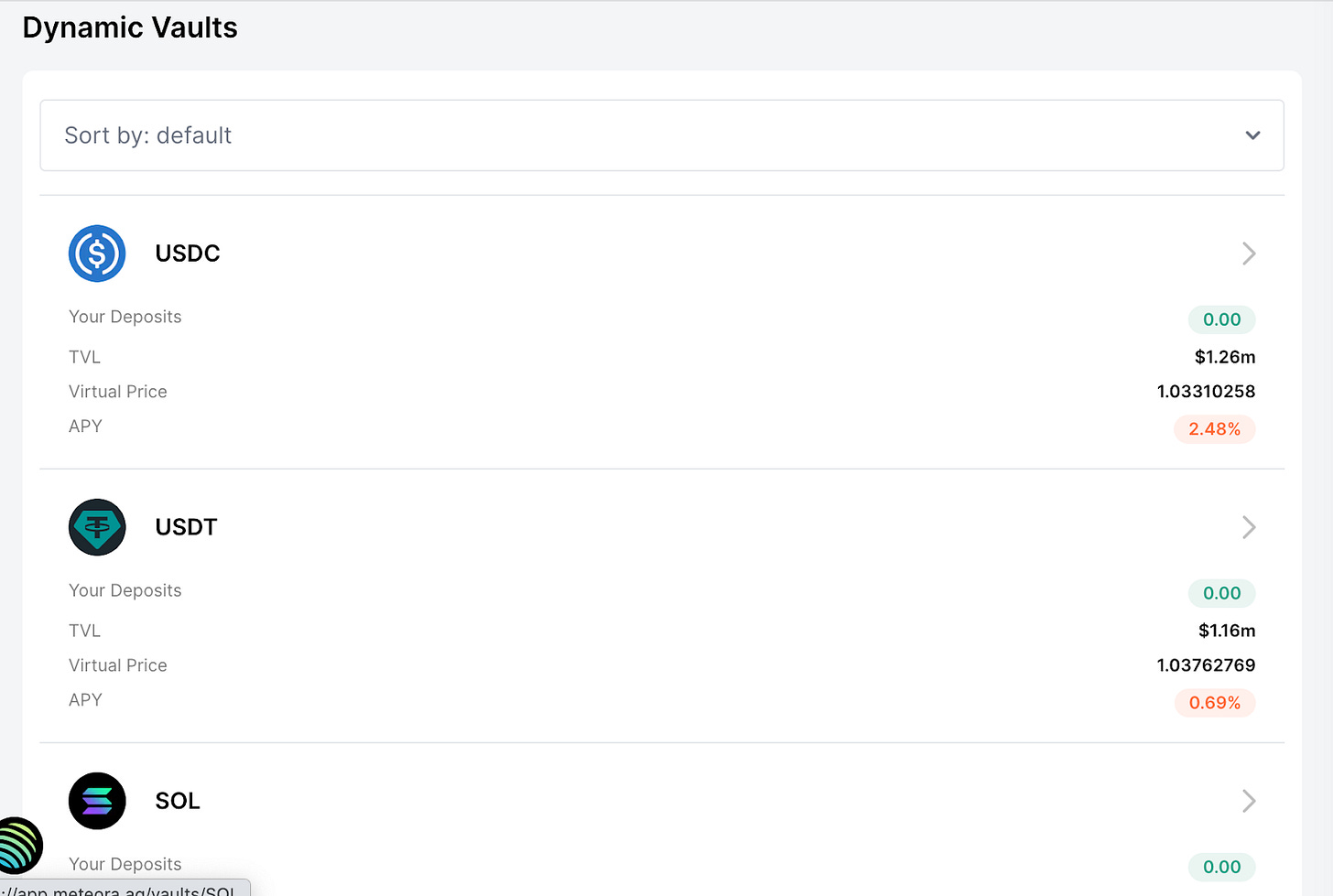

USDC Vault:

APY performance of the USDC dynamic vault:

SOL vault:

If you are a farmer, you can go to LP farming:

Future of Meteora

As we look towards the future, Meteora is poised to continue its mission of becoming the liquidity backbone of Solana. The platform's innovative features, such as Dynamic Vaults, have already demonstrated their ability to optimize yield and protect capital, making DeFi more accessible and safer for all users. However, the journey doesn't stop here.

Conclusion

Meteora is a pioneering platform in the DeFi space. Its innovative features, such as Dynamic Vaults, are revolutionizing the way yield farming is approached, making it more accessible and safer for all users. With its robust risk management framework and commitment to continuous improvement and expansion, Meteora is set to become a key player in the DeFi ecosystem.

REFERENCES:

Meteora Docs (https://docs.meteora.ag/)

Meteora Site (https://app.meteora.ag/)

Defillama (https://defillama.com/)